When you purchase through our links, we earn commissions at no extra cost to you.

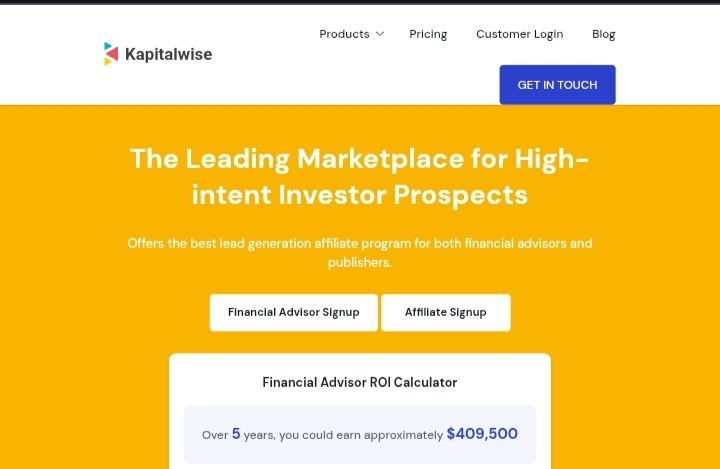

KapitalWise is a fintech business that provides financial institutions with AI-powered client engagement solutions. KapitalWise optimizes customer connections for banks, credit unions, and financial advisors with advanced automation and behavioral analytics. The company’s revolutionary technology simplifies marketing efforts, allowing financial professionals to generate pre-qualified leads, nurture client relationships, and improve retention methods. KapitalWise’s solutions are designed to work smoothly with existing financial workflows, providing institutions with data-driven insights that lead to improved customer experiences and revenue potential.

In modern tough financial environment, client expectations are rapidly changing. Financial institutions must adapt by implementing intelligent engagement tactics tailored to individual client demands. KapitalWise tackles this issue by providing automated, individualized engagement at scale, ensuring that financial professionals remain competitive in a digital-first environment. This article delves into KapitalWise’s services, its unique approach to financial engagement, and how it helps financial institutions.

Company Overview

KapitalWise, established in 2017 and based in New York, has established itself as a market leader in artificial intelligence-powered financial interaction. The company specializes in helping financial institutions improve client experiences through predictive analytics, behavioral insights, and automation. KapitalWise helps financial institutions enhance efficiency, conversion rates, and develop long-term client relationships by employing data-driven tactics. KapitalWise has been recognized for its creative approach through participation in some of the world’s most famous fintech accelerator programs, such as Barclays Techstars and the Fintech Innovation Lab. These initiatives offered KapitalWise with mentorship, networking opportunities, and strategic collaborations, allowing the company to improve its technology and increase its market reach.

The company is backed by significant investors such as Techstars, Breega Capital, and the Independent Community Bankers of America (ICBA), indicating high industry confidence in its solutions. KapitalWise’s commitment to innovation and customer-centric engagement has established it as a reliable partner for financial institutions looking to update their client contact methods. KapitalWise now serves a varied client base, including banks, credit unions, financial advisors, and publishers eager to include AI-powered financial solutions into their platforms.

Product Offerings

They offers a comprehensive set of AI-powered solutions intended to improve financial marketing, expedite client interactions, and strengthen the general clientele of financial institutions. Every product is designed to tackle the main issues of attracting, keeping, and making money from customers.

Pre-qualified leads

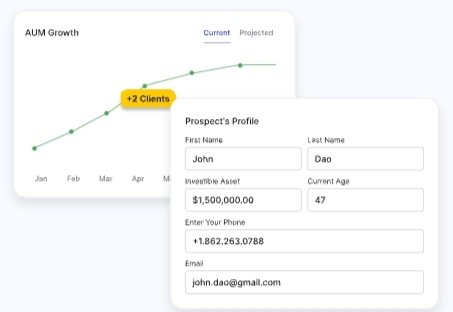

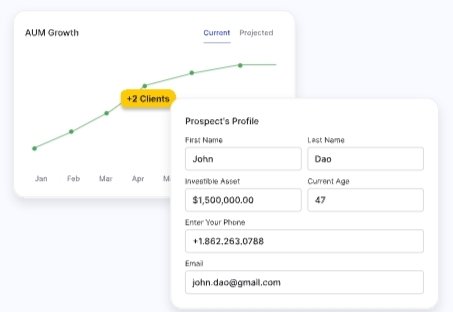

The platform helps financial institutions get pre-qualified leads by combining AI-powered insights and behavioral analytics. KapitalWise assists banks and advisors in identifying high-value prospects by analysing consumer behaviour, spending habits, and financial purpose. This service considerably boosts conversion rates while lowering acquisition costs, ensuring that institutions target the appropriate customers at the right time with relevant offers.

Smart Financial Insights

KapitalWise’s AI-powered Smart Financial Insights platform delivers real-time, actionable financial analytics to institutions and advisers. By analyzing massive volumes of consumer data, the platform provides predictive insights, allowing financial experts to anticipate client needs and provide proactive financial advise. This tool assists institutions in optimizing decision-making, increasing client happiness, and maximizing cross-sell and upsell prospects..

Engagement Builder

The Engagement Builder is a powerful automation solution that enables financial advisers and institutions to foster client relationships through individualized interactions. It automates communication tactics and offers targeted content that is relevant to clients’ financial needs by leveraging AI-driven data insights. This solution increases customer loyalty by guaranteeing timely and meaningful interactions across several channels, including email, SMS, and in-app messaging.

Connect Widgets for Publishers

KapitalWise provides highly interactive monetization widgets to digital content creators and publishers, seamlessly integrating financial solutions into websites, blogs, and digital platforms. These widgets enable publishers to increase revenue streams by adding financial solutions that improve audience engagement. By providing relevant financial solutions, content providers may give value to their users while increasing engagement and monetization options.

Automated Marketing Campaigns

The company simplifies digital marketing for financial institutions through its Automated Marketing Campaigns feature. This tool allows banks and advisors to set up AI-powered campaigns that dynamically adjust to customer behavior. By segmenting audiences and delivering hyper-personalized content, this feature ensures that institutions can run highly effective campaigns with minimal manual intervention, resulting in improved engagement and higher conversion rates.

Client Acquisition and Retention Strategy

They leverages AI, behavioral analytics, and automation to enhance client acquisition and retention. The platform identifies key moments in a client’s financial journey, allowing financial institutions to engage with customers in a timely and relevant manner.

Tailored Client Experiences

KapitalWise develops dynamic, customized client experiences that complement each person’s financial objectives. The technology helps financial institutions to efficiently segment their clientele by examining transactional data, online activity, and financial practices. This guarantees that customers receive financial advice, product offers, and suggestions that are tailored to their individual requirements, increasing client happiness and engagement overall.

Predictive Analytics for Proactive

Engagement Financial professionals can foresee client demands before they materialize thanks to KapitalWise’s AI-driven predictive analytics. The platform enables banks and advisors to proactively provide pertinent solutions, such credit products, investment opportunities, or savings programs, by seeing trends in spending patterns and life events. By being proactive, institutions are positioned as useful financial partners and trust is increased.

Automated customer interactions

The KapitalWise platform automates customer interactions across many touchpoints, resulting in consistent and timely engagement. Financial organizations may engage customers without overwhelming their support personnel by using AI-powered chatbots, automated email sequences, and personalized financial suggestions. This automation improves productivity while yet providing a high level of customisation.

Customer Retention Strategies

The platform assists financial institutions in developing effective retention strategies by identifying at-risk customers and providing tailored solutions. The platform’s analytics detect early indicators of disengagement, allowing institutions to take proactive steps such as providing exclusive promos, individualized financial education content, or targeted investment options. This data-driven approach lowers churn and promotes long-term customer connections.

Deployment Options

KapitalWise offers flexible deployment methods to accommodate different financial institutions, ensuring that organizations of all sizes can integrate its AI-driven solutions seamlessly.

- Secure Cloud: Financial institutions can implement KapitalWise’s services without having to make large infrastructure investments thanks to this scalable, secure, and reasonably priced cloud-based solution. High availability, smooth upgrades, and strong security compliance are guaranteed with this choice.

- On-premises: Made for financial institutions that need to comply with stringent regulatory requirements and maintain internal data control. This deployment approach gives organizations complete control over data protection, allowing them to take advantage of KapitalWise’s AI-powered engagement capabilities while upholding governance rules.

- Hybrid: A mix of on-premises and cloud technologies designed to meet particular business requirements. By using a hybrid strategy, financial institutions can benefit from the scalability of cloud-based solutions while keeping sensitive data and some essential tasks in-house. For organizations trying to strike a balance between security, flexibility, and regulatory compliance, this is the best choic

Pricing Plans

Free Trial ($0/month – 60 Days)

- Customer experience automation

- Lead-generation automation

- Engagement builder with automation templates

- 2,000 contacts & unlimited landing pages

- Audience segmentation & web analytics

- Pipeline & lead activity tracking

- Up to 5 users

Essential Plan ($300/month or $3,600/year)

- All Free Trial features

- Compliance workflow & dedicated email IP10x email sends

- Access to financial blogs (5 included)24/7 technical support

- Up to 10 users

Enterprise Plan (Custom Pricing)

- All Essential Plan features

- Core banking & fintech integrationAI-driven insights & event tracking

- FICO score monitoring & credit tracking

- On-premise hosting options

Additional Services (Optional)

- Extra emails, users, and dedicated IPs

- Marketing & content strategy consulting

Conclusion

KapitalWise is revolutionizing how banks interact with their customers. KapitalWise improves customer acquisition, retention, and monetization through the use of automation, behavioral analytics, and insights driven by AI. KapitalWise’s cutting-edge solutions are highly advantageous for financial advisers and organizations seeking to enhance customer connections and maximize financial marketing.

Important Links:

Career.ai Review and

caree